|

||||

|

||||

|

|

||||

|

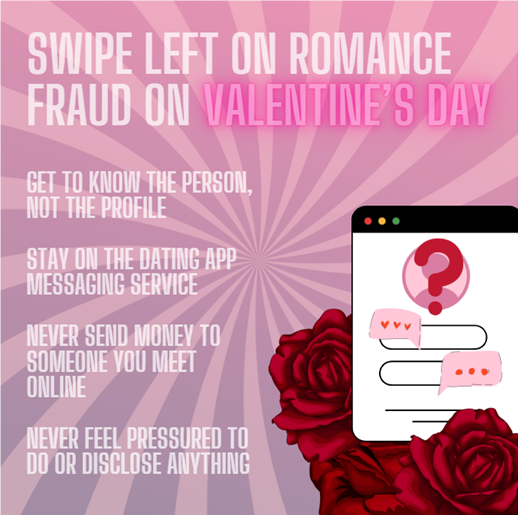

This Valentine’s Day, we want to ensure the right people are getting your love. Romance fraud is one of the highest reported frauds in Surrey and Sussex. Last year we received over 600 reports, and the victims suffered a total financial loss of over £7 million. Whilst victims of romance fraud can be any age, the majority of reports come from the over 50s. However, it is a common misconception that this crime type favours women, and our reports show a near even split, with 48% male victims and 52% female victims. Fraudsters make contact through various means including dating sites, Facebook and other social media platforms, and in person. They will research social media or dating profiles in order to present themselves as the ‘perfect match’, and swiftly encourage victims to move to messaging on less monitored platforms such as WhatsApp, Google Hangouts, and Telegram. Requests for money do not happen straightaway. A fraudster will make sure they know their victim well first, establishing what appears to be a genuine relationship over several weeks or even months. This is known as ‘the grooming period’. They may use language to manipulate, persuade, and exploit so subsequent requests for money do not raise alarm bells. Payment is most commonly made through bank transfers, but last year gift cards including iTunes vouchers became the fastest growing payment type. One victim in Sussex sent a fraudster over £100,000 through gift cards. We have shared her story below: In March 2022 the victim accepted a friend request on a Facebook group for dog lovers. This friendship developed into what she believed to be a genuine relationship. The scammer told her he worked overseas as an engineer & oil rig contractor, and often claimed to be in poor health or that his money had been frozen. Wanting to help, the victim was instructed to purchase Apple iTunes vouchers and share the barcodes with the scammer so he was able to cash them. She also sent over additional sums of money, thinking that she was paying for hospital bills for transfusions and other procedures. The scammer also claimed his ‘daughter’ was in a coma and an alleged doctor contacted the victim requesting that she pay the medical bills. The manipulative and coercive pleas from the scammer had such an impact on the victim that she ended up taking out a £32,000 mortgage on her home, and a £12,00 bank loan. She sold shares, borrowed money from relatives, and pawned family jewellery, and was constantly in her overdraft. Eventually her family became aware of the extent of the fraud, and it was reported to Police, and she was supported by a Victim Support Caseworker. No matter how long you have been talking to someone online and how much you think you trust them, if you have not met in person, it is important that you do not: For more information about protecting yourself from romance fraud, visit https://www.actionfraud.police.uk/a-z-of-fraud/dating-fraud If you think you have been a victim of a romance scam, do not feel ashamed or embarrassed - you are not alone. Contact your bank immediately and report it to Action Fraud on 0300 123 2040 or via actionfraud.police.uk.

| ||||

Reply to this message | ||||

|

||||

|

|

|